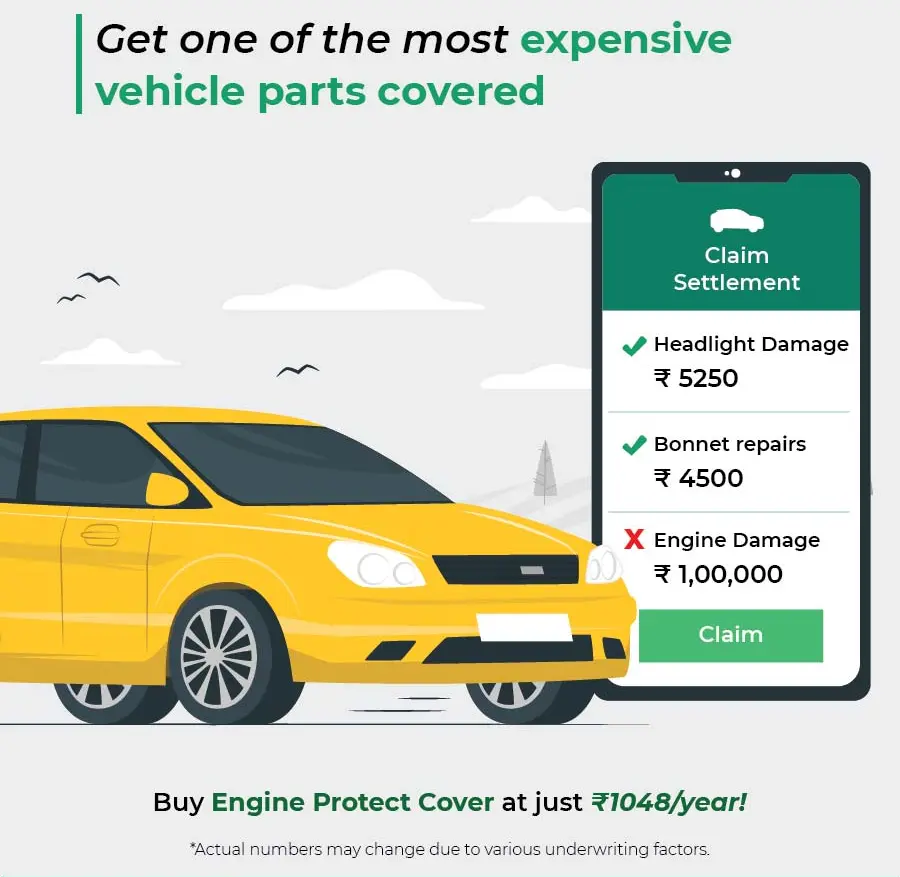

Car Insurance

There are various types of car insurance which may often overwhelm you, here is a brief on each of these to help you understand what they cover. This will help you assess the suitability and accordingly choose the plan that best aligns with your requirement.

Apply Now

Byke Insurance

A two-wheeler insurance policy is a policy which provides insurance coverage to the bike, as per the provisions of the Motor Vehicles Act, 1988. The policy provides coverage against the accidents caused by the bike or suffered by the bike as per the type of policy selected.

Apply Now

Health Insurance

Healthcare expenses during old age can put a significant burden on finances. Investing in a comprehensive health insurance plan is a must to manage the expenses of regular medical care as well as unexpected medical emergencies. The premium paid towards health insurance also helps save income tax for senior citizens under section 80D.

In cases, when due to an underlying health condition or a pre-existing disease, getting health insurance becomes difficult or too expensive for senior citizens, they can save income tax by claiming tax deduction on medical expenses, provided the payment is done in a mode other than cash.

Life Insurance

Life insurance is a mutual agreement between an insurance company and a policyholder. Under this agreement, the insurer provides the nominee of the insured a death benefit or fixed sum of money in the event of the demise of the insured within the policy duration. This ensures financial security for the loved ones of the policyholder in the unfortunate event of the latter’s demise. Your family can continue managing their expenses without worry with the lump sum amount provided by the insurer under your life insurance policy.

Get Quate